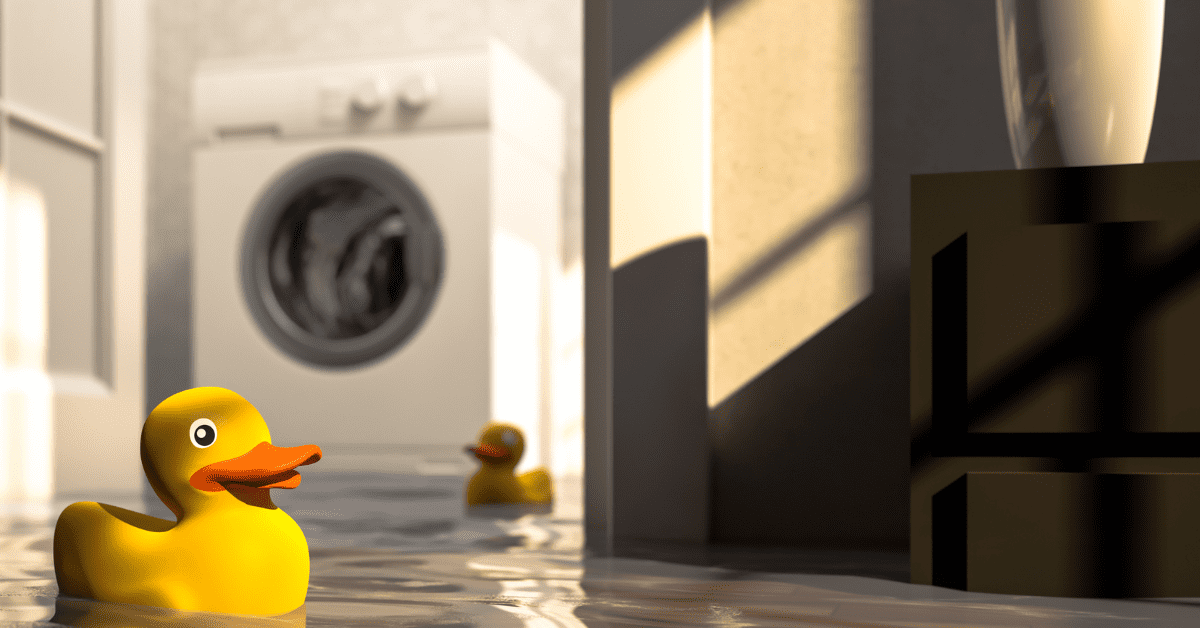

You know the feeling: You’re walking through your home, and you hear a drip, spray, or even worse, gushing water. You transform into a crisis management machine, working to get the leak located and turn off the water before you have extensive damage and loss. You take a breath, look around, your stomach sinks, and you feel a sense of dread as you wonder whether or not your insurance coverage is going to be enough to protect you and your home.

I’m Michelle O’Connor, owner of O’Connor Insurance Associates, and I want to take some time to share a few crucial insights about home insurance that could save you from unexpected headaches and financial setbacks. So, this is what you need to know BEFORE your home is damaged by water.

1. Not All Home Insurance Is Created Equal

One of the common misconceptions is assuming that all home insurance policies offer the same coverage. The truth is there are vast differences among policies, and home insurance is not a one-size-fits-all situation.

It’s essential to have an agent who can guide you through these differences and help you select the coverage that best suits your needs and family.

2. Special Items May Require Special Attention

It is critical to be aware that your standard home insurance may not cover everything inside your home. Consider those valuable collectibles or that new engagement ring. These items may have elevated value that requires additional coverage.

When it comes to your precious assets and valuables, having a conversation with a trusted agent can help you determine if a rider is needed to ensure proper protection.

3. The Power of Deductibles in Saving Money

Deductibles play a crucial role in your home insurance policy. Essentially, a deductible is the amount of money you agree to pay out of pocket before your insurance coverage kicks in to cover a loss. Opting for a higher deductible, such as $2,500 instead of $250, can lead to significant cost savings on your insurance premiums. However, it’s essential to ensure that you have the deductible amount set aside in case you need to file a claim. While choosing a higher deductible can result in lower premiums over time, it’s crucial to weigh the potential savings against your ability to cover the higher out-of-pocket expense in the event of a claim.

Additionally, some insurance policies may offer different deductible options for different types of claims, such as a separate deductible for wind or hail damage. Understanding your deductible options and how they affect your coverage and premiums is key to making informed decisions about your home insurance policy. Talk to a trusted agent to ensure you understand the ins and outs of deductibles and how they affect your policy coverage.

4. Bundle Your Policies for Extra Savings on Your Home Insurance

Did you know that bundling your insurance policies not only saves you money but also simplifies your life?

By consolidating your auto and home policies with the same company, you not only unlock substantial discounts but also enjoy the convenience of managing all your insurance needs under one roof. It’s a win-win situation that shouldn’t be overlooked when shopping for insurance coverage.

5. The Importance of a Trusted Agent

Perhaps the most vital piece of advice is to have a trusted agent by your side. An agent who not only educates you but also asks the right questions to provide the information you need. This ensures you make informed decisions about the coverages necessary to protect your family’s financial future.

Having a trusted agent, understanding policy differences, addressing special items, optimizing deductibles, and bundling policies are key elements in ensuring you are properly protected BEFORE a catastrophe hits.

At O’Connor Insurance Associates, we pride ourselves on being that trusted agent for our clients. Reach out to us today to get all of your questions and concerns addressed. With our expertise and personalized service, we’re here to guide you every step of the way.

Keep Yourself In the Know

Remember, informed decisions today can prevent hearing those dreaded words, “I’m sorry, that’s not covered,” tomorrow. Don’t hesitate to reach out to us for all your insurance needs or questions. As an agency, we are dedicated to educating individuals about insurance coverage and connecting them with the right policy for them. If you want to learn more about what you need to know BEFORE an accident happens, check out our 4-part videos series: What You Wish You Knew Before the Incident.