Life insurance is not a one-size-fits-all cost structure. There are many unique factors involving your personal health history and your family health history that are factored into the rate structure for life insurance to determine your overall cost. This article will cover the top decisions of your life insurance cost.

Age is the first factor to be considered in how much your life insurance will cost. Today you are as young as you will ever be. With that in mind, you can save a significant amount of money on life insurance by purchasing it now. Think about it for a moment. If you purchase a 30-year term life insurance policy when you are 25 the odds are in your favor that you will outlive the life insurance policy. For that very reason, the life insurance company charges a much lower rate to you. If you want to buy that same 30-year term life policy when you are 60 the life insurance company is well aware there is a higher likelihood the death benefit will be paid in that 30 years as odds are very few people live past 90 years old. Buy life insurance today when you are as young as you will ever be and give your family the protection they deserve.

Height and weight play a part in how much your life insurance will cost. If you are tall and thin you will pay less than if you are short and 80 pounds overweight. The height and weight chart determining the pricing is different with each life insurance company. It is common for me to hear clients say they are going to lose that 20 pounds they have been wanting to lose and then apply for life insurance. There is a problem with that logic. Most insurance companies ask on the application if you have lost weight in the last year. They will only consider 50% of whatever you have lost towards your current weight. If you haven’t lost the weight when you apply you may be eligible to the policy pricing reevaluated if you do lose weight and keep it off. Ask your agent when you are completing the life insurance application.

Tobacco use plays a significant factor in your life insurance cost. If you smoke a pack a day expect you are going to pay more. If you smoke a cigar on New Year’s Eve once a year you may qualify with some companies as an occasional tobacco user. Chewing tobacco leads to an increased cost as well. If you do use tobacco don’t let that deter you from purchasing a life policy. Remember you are still as young as you will ever be today. Some life companies have “preferred” tobacco use pricing. Working with our agency we represent many different life insurance companies and will shop around for you to make sure you are getting the best tobacco use price. Some life insurance companies will even reevaluate your rate if you stop using tobacco for a certain amount of time, usually a year.

Current and past medical history plays a part in your life insurance cost. If you have had a serious illness or complication, you may not be eligible to buy life insurance until a certain time frame has passed, which varies depending on the serious issue. This is one of the many reasons why you never wait to buy life insurance. You never know what may be around the corner. A healthy 48-year-old who has a heart attack tomorrow would not be eligible for life insurance for many years. Medical history is one very important reason why people should consider permanent life insurance policies for children. If your child is diagnosed with childhood diabetes the life insurance policy he/she might purchase as an adult would cost much more than someone without diabetes. If you purchase one when they are small that has the option to buy more life insurance as they age you could be giving them a priceless gift. You can learn more about Child Life Insurance here. https://oianc.com/life-and-disability-insurance/child-life-insurance/

Part of the life insurance application is getting medical records from your doctors. These records will help the life insurance companies in reviewing your health history. Most life insurance policies will require a paramed exam. That is when a nurse takes a brief application, checks your height, weight and does a blood and urine sample. This establishes your current statistics used in determining the cost of your life insurance.

Your immediate family’s health history plays a part in your life insurance cost. There are many variables that are considered. Be prepared to share some information about the health history of your immediate family. Cancer, heart conditions, and other hereditary medical questions will be asked not only of you but for those closest to you when you complete the application.

Your hobbies can impact how much you pay for life insurance. If you love sky diving or motor cross racing be prepared to pay more. It makes sense that someone who likes hobbies that are potentially fatal would have a higher-than-normal chance of dying and that means the price will cost more. Remember, life insurance is in place so you can enjoy life while ensuring your family is taken care of in the event you die.

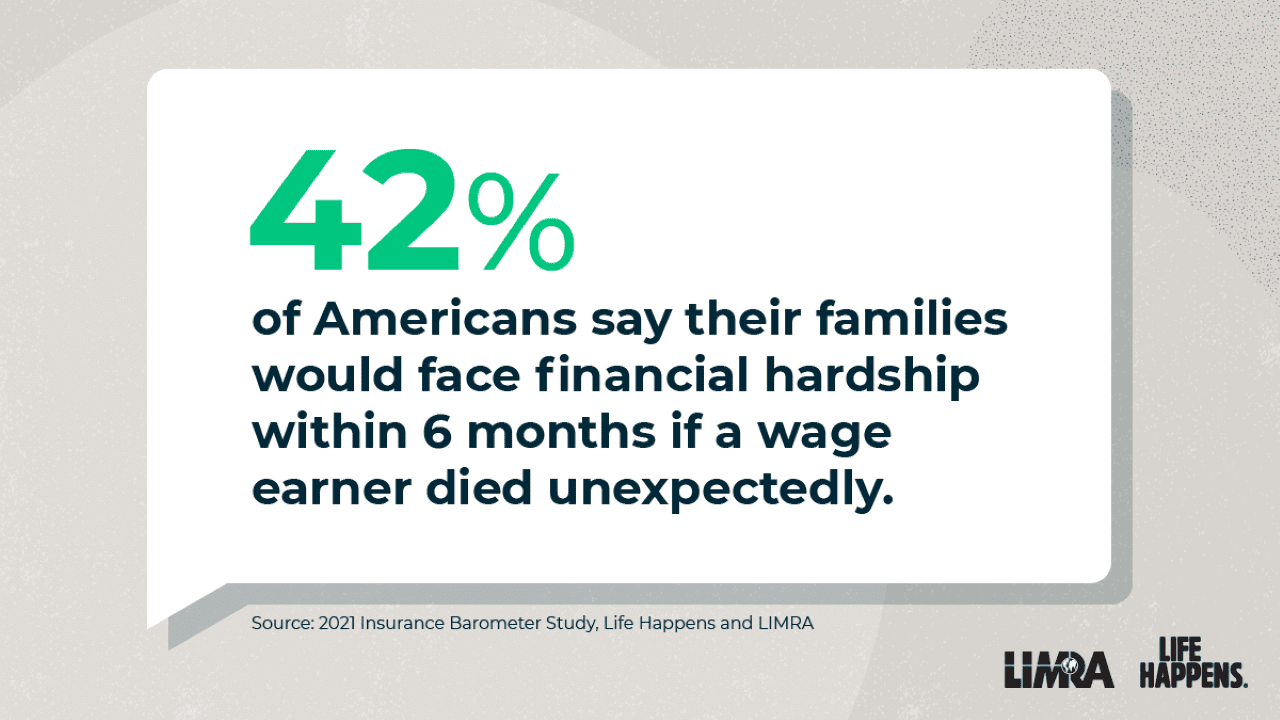

The amount of life insurance you buy impacts the cost. This probably goes without saying but the more you buy the more you will pay. It is very important to complete a life insurance calculator like the one we have on our website to determine how much you need. You do not want to purchase more than what your family will need but you never ever want to purchase less than they may need. Without you, they will be faced with tremendous grief and by providing life insurance you will ensure they are not faced with financial uncertainty.

There are several different types of life insurance you can learn about on our website life insurance page. If you purchase term insurance the length of time you have the policy in force will play a factor in the cost. A 10-year term policy will be less than a 30-year policy. The length of time is dependent on just how long you need life insurance. If you have very young children, you will want life insurance provided until they are out of the house and able to provide for themselves. If your children are grown, you may want to use life insurance to provide a legacy for them or your grandchildren.

For years I have told clients never to wait when it comes to buying life insurance. Today, this minute, you are as young and as healthy as you will ever be. No one knows what will happen in the next hour let alone next week. If you want to provide financial assistance to those you love the most when you are no longer here purchase life insurance today. O’Connor Insurance represents several life insurance companies and will work with you to determine the best price based on your unique situation. Call us today at 704-510-8884 or visit our website to start a quote or book an appointment.